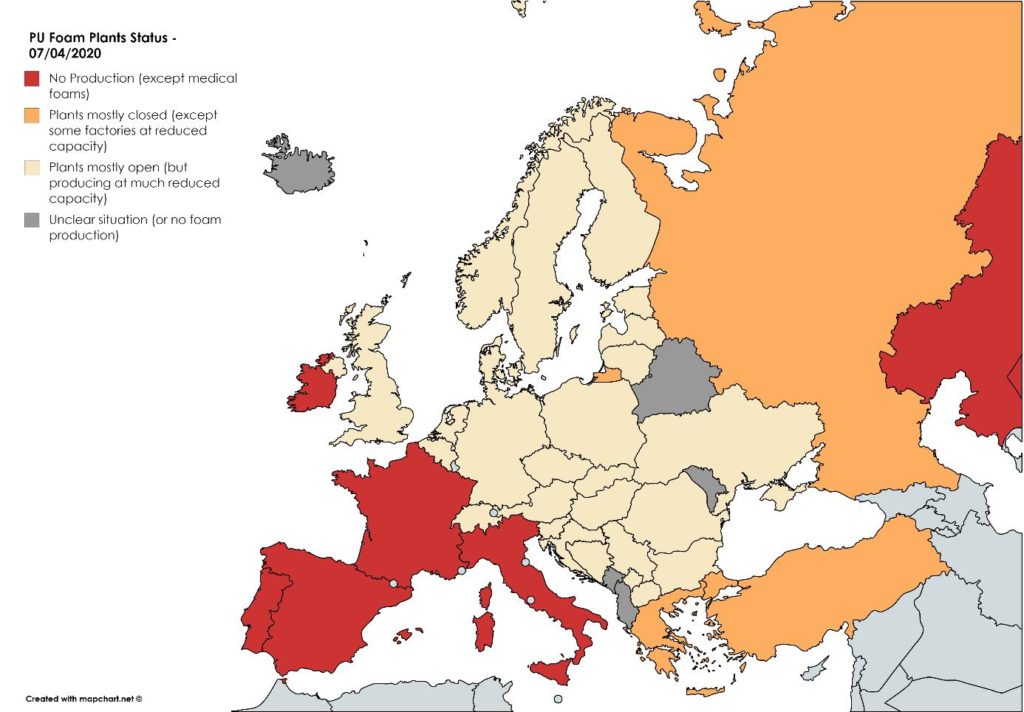

Europur, the European Association of Flexible Polyurethane Foam Blocks Manufacturers, carries out continued interviews with foam producers and suppliers on the situation in Europe’s foam industry. In an update from 7 April 2020 it said that in most of Europe, there have been no government orders demanding the closure of foam plants and normal operation would be allowed as long as measures to protect the workforce are taken. Production is, however, drastically reduced due to lack of demand for foam and closure of many companies further down the supply chain.

The association said that foam plants serving the automotive industry are nearly all closed but internal preparations are being made for restarts. Some OEMs plan to reopen around 20 April, but this is still quite uncertain since the automotive supply chain is among the most integrated globally. There are some reports of a re-start of technical foams exportation to Asia.

Europur said that foam plants producing for the mattress and furniture industry expect a reduced production by 30 to 90 % in April with retail closed in most of Europe. Production of materials for medical mattresses continues, as does the online sales of mattresses and furniture.

Europur estimates that the production across Europe will be down 60-70 % in April. Some plants announce short periods of closure around the Easter holidays. However, shipments of foam from existing stock continue and can satisfy the low demand.

- Austria, Germany and Switzerland: Operation at much reduced capacity. Most PU foam produced is for special orders (e.g. medical mattresses) or online sales.

- Benelux: Operating at much reduced capacity. Most PU foam produced is for special orders or online sales.

- France: Foam plants are closed. No formal government order imposing the closure, however due to lack of demand, all companies are almost completely closed with some orders for medical foams.

- Greece, Balkans and Cyprus: Most operating at much reduced capacity due to lack of demand. In Greece, most foam plants serving the comfort sector are closed.

- Hungary, Czech Republic, Croatia, Slovakia, Slovenia: Operating at much reduced capacity due to lack of demand.

- Iberia: Most foam plants are closed. From 9 April non-essential industrial businesses will be allowed to open again. However, retail will remain closed until the end of the month, therefore huge demand for foam is not expected. All but two foam producers are completely closed. Remaining production is at very low volume for specific applications (mostly sponges, medical mattresses).

- Italy: Foam plants are closed. The current lockdown has been extended until 12 April but is likely to be prolonged. The government imposed a closure of all non-essential businesses 3 weeks ago but the plastics and rubber industry was among the industries that could remain operating. Non-medical mattress and furniture industries are not on the list of essential businesses. Some foam plants provide support to local initiatives to produce medical equipment.

- Poland: Operating at much reduced capacity. There is no government order imposing the closure of foam plants. Plants may continue operating provided precautionary measures are taken. Due to low demand foam plants operate at much reduced capacity.

- Romania and Bulgaria: Operating at much reduced capacity. Similar to Poland – reduction in demand has strongly affected local players who are producing at much reduced capacity.

- Turkey: Most PU foam plants are closed. Two foam producers are resuming activity at much reduced capacity as part of precautionary measures to protect the workforce.

- Scandinavia and the Baltics: Operating at much reduced capacity. The reduction in production seems to be somewhat less dramatic than in other regions of Europe.

- UK and Ireland: Operating at much reduced capacity. In Ireland, all non-essential businesses were closed as of 28 March, but the country’s foam industry is continuing reduced operations to produce foams for medical equipment. UK plants are operating, but at much reduced capacity due to low demand.

- Ukraine, Russia, Belarus, Kazakhstan: Mix of open and closed plants. In the course of last week, the Russian government extended the national holidays it had initially imposed for one week until 30 April. But the government’s decision leaves it to each State of the Russian Federation to decide whether companies can open or close depending on the local spread of the virus. The situation is therefore changing very often. Europur said that at this moment most PU foam plants are closed but that some have obtained authorization from local authorities to remain in operation. In Kazakhstan foam plants are closed by order of the government. In Ukraine, foam production is strongly reduced.